|

|

Table of Contents

Record High Percent

Introduction

Record High Percent is a breadth indicator based on new highs and new lows. New highs are the number of stocks recording new 52-week highs. New lows are the number of stocks recording new 52-week lows. The indicator is derived by dividing the number of new highs by the number of new highs plus new lows. This ratio shows new highs relative to the total (new highs plus new lows). Like all breadth indicators, Record High Percent is a measure of underlying strength or weakness in a particular index. StockCharts.com calculates Record High Percent for several major indices.

Calculation

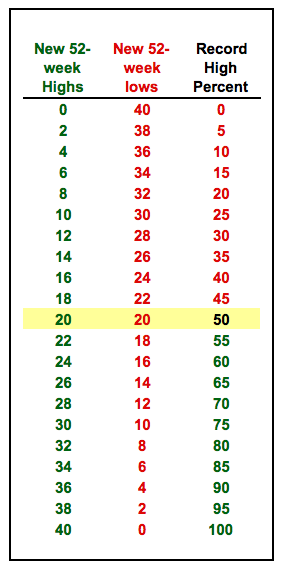

{New Highs / (New Highs + New Lows)} x 100

As the formula implies, Record High Percent shows the number of new highs relative to the total (new highs plus new lows). The total is multiplied by 100 to create round numbers that fluctuate between 0 and 100. The table above shows various possibilities based on an index with 100 stocks, such as the Nasdaq 100 or S&P 100. Rarely do all 100 stocks record a new high or new low. Readings below 50 (50%) indicate that there were more new lows than new highs. Readings above 50 (50%) indicate that there were more new highs than new lows. 0 indicates there were no new 52-week highs (0% new highs). 100 indicates there was at least 1 new high and no new lows (100% new highs). 50 indicates that new highs and new lows were equal and greater than zero (50% new highs and 50% new lows). This could be 4 new highs and 4 new lows or 20 new highs and 20 new lows. Rarely will there be a high number of new highs and new lows.

Interpretation

In general, a stock index is deemed strong (bullish) when Record High Percent is above 50, which means new highs are greater than new lows. Conversely, a stock index is deemed weak (bearish) when Record High Percent is below 50, which means new lows are greater than new highs. This indicator can move to its extremities and remain near its extremities when the underlying index is trending one way or the other. Readings consistently above 70 indicate a strong uptrend. Readings consistently below 30 indicate a strong downtrend. Record High Percent can also bounce between zero and one hundred during corrective periods or choppy periods.

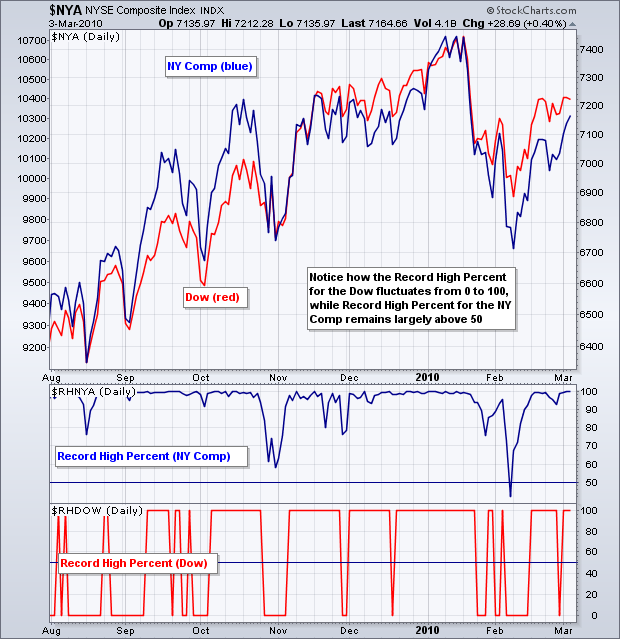

Because Record High Percent shows the percentage of new highs, this number can be deceiving. For example, an index could have 4 new highs and 1 new low. The Record High Percent would be 80 {(4/(4+1))*100}. While this reading seems strong, four new highs is not that strong. Similarly, Record High Percent based on stock indices with 100 or fewer stocks will reach extremes more often than broad-based indices. Record High Percent for Nasdaq 100, S&P 100 and Dow Industrials will have more volatility and noise than Record High Percent for the S&P 500, Nasdaq and NYSE.

Chart 2 shows Record High Percent for the Dow in red (bottom) and Record High Percent for the NYSE in blue. Notice how the Dow High-Low Index hits extremes on a regular basis. This is because there are only 30 stocks and it is rather easily skewed. In contrast, the NYSE High-Low Index is more stable and remains largely above 50 during the entire uptrend. The NYSE trades over 3000 stocks per day and is not easily skewed. In general, broader indices usually work better for breadth statistics.

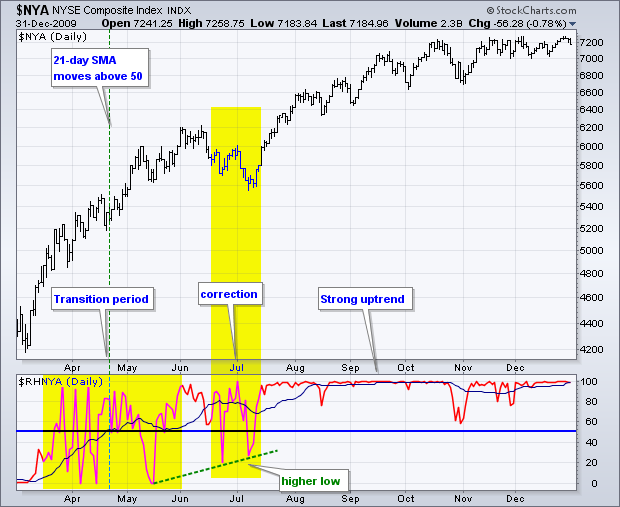

Uptrend Transition

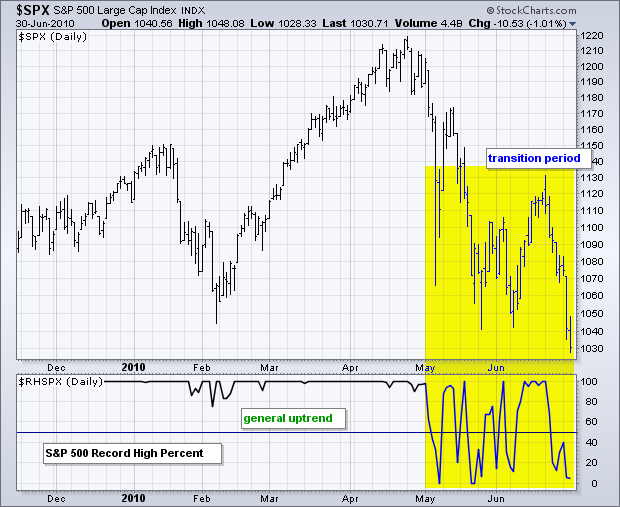

Chart 3 shows the NY Composite with the NYSE High-Low Index ($RHNYA) in 2009. Here we can see Record High Percent in a transition period, a corrective period and a strong uptrend. First, there is the transition period from downtrend to uptrend (bear to bull). The NY Composite just came off of an extended decline (October 2007 to March 2009). An extended advance is needed before Record High Percent can generate plenty of new highs. The NY Composite surged in March-April-May, but Record High Percent fluctuated between 0 and 90 during this timeframe. There were two dips to the zero line in April and one in mid-May. The period from mid-May to early July is deemed a corrective period because Record High Percent formed higher lows. Notice how the index remained above zero and above the May low. The third period is the strong uptrend. After the June-July pullback, Record High Percent (red) surged to 100 and remained above 50 the rest of the year. In fact, Record High Percent remained largely above 75 until year end. This showed underlying strength.

The blue line in the indicator window shows the 21-day moving average of Record High Percent. 21 days covers roughly one month. Smoothing Record High Percent with a moving average will eliminate some of the extremes (above 90 or below 10). This moving average will also smooth the indicator and make it less volatile. Notice how the 21-day SMA moved above 50 in late April and remained above 50 the entire year. Even with the dips in May, June and July, the 21-day SMA held above 50 to show continued strength in new highs.

Downtrend Transition

Chart 4 shows the Nasdaq with Nasdaq Record High Percent (red) in 2007 and 2008. Here we can see Record High Percent transition from bullish to bearish and then move into a strong downtrend. Because the daily readings can be quite volatile, I am also showing the 21-day SMA of Record High Percent (blue line). First, the 21-day SMA dipped below 25 in August (1). This occurred during what appeared to be a minor correction, but the indicator showed underlying weakness because new lows expanded. The second warning came as the Nasdaq hit a new high in late October 2007 and Record High Percent did not exceed 75 (2). Record High Percent peaked a few weeks earlier to form a bearish divergence. The third and final straw occurred when the 21-day SMA moved below 50 in November and remained below 50 (3). This expansion of new lows showed underlying weakness in Nasdaq stocks.

How do we know when the 21-day SMA will move above/below 50 and remain above/below 50? We can never really be sure, but we can use other aspects of technical analysis to confirm or refute the indicator. The first two bearish signals in Record High Percent indicated underlying weakness in Nasdaq stocks because new lows were expanding. After the November 2007 decline, the Nasdaq bounced in December and formed lower highs (red arrows). The index then broke support to reverse the uptrend. This support break confirmed weakness that was already present in Record High Percent and its 21-day SMA. The 21-day SMA subsequently remained below 50 until April 2009.

Quirks

New 52-week highs and new 52-week lows are considered lagging indicators. In other words, the market will change direction long before there is a significant shift in the number of new 52-week highs and the number of new 52-week lows. Think about it. It takes at least 52 weeks to forge a new high or a new low. Therefore, an extended move is required for a stock to record a 52-week milestone. There are plenty of new highs after an extended advance, just as there are plenty of new lows after an extended decline. New highs dry up when a stock index corrects after an extended advance. Some new lows will surface during a correction, but it takes an extended decline to generate a serious increase in new lows. Similarly, new lows dry up when a stock index bounces after an extended decline. Some new highs may surface during this bounce, but it takes an extended advance to generate a serious increase in new highs.

Conclusions

Record High Percent is a breadth indicator specific to an underlying index. Nasdaq 100 Record High Percent applies to the Nasdaq 100, NYSE Record High Percent applies to the NY Composite and so on. Broad-based indices, such as the Nasdaq and NYSE, can be used as barometers for the “market”. The Record High Percent numbers for broad indices are not as easily swayed as the numbers for the Dow, Nasdaq 100 or S&P 100. In general, the bulls have an edge when Record High Percent for the Nasdaq and the NYSE are both above 50.

The examples above show Record High Percent with a 21-day simple moving average. Chartists can experiment with different moving average lengths to fit their desired timeframe and trading/investing style (short-term, medium-term and long-term). Chart 5 shows the Nasdaq with Record High Percent and its 21-day SMA in the first indicator window. The second indicator window shows the 63-day, 125-day and 250-day SMAs. Record High Percent is invisible on the second indicator window to focus on the moving averages.

SharpCharts

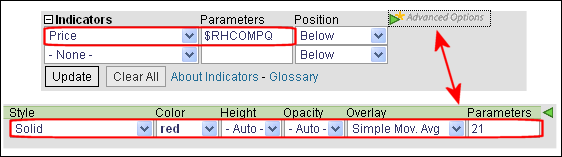

SharpCharts users can plot Record High Percent for several indices, including the S&P 500, TSX Composite and Dow (see list below). It is often helpful to plot the index along with the indicator for easy reference. Record High Percent can be plotted in an indicator window or in the main chart window. It can even be plotted behind the price plot for the stock index. In this example, the index is shown in the main window with Record High Percent below in an indicator window. Here are the steps.

- First, enter the index symbol in the “symbol” box in the upper left.

- Second, go to “indicators” and select “price.”

- Third, enter the symbol for Record High Percent in the “parameters” box.

- Fourth, select “above, below or behind” for the “position” of the indicator plot.

Click “Update” to see the chart. Record High Percent can be made invisible by using a “Style” setting. A moving average can be added by choosing “Advanced Options” and selecting an “Overlay” option. Click here for a live example.

Symbol List

StockCharts.com users can access an up-to-date list of symbols for all our Record High Percent Indicators. From this list, click the “Mentions” icon to the right of a specific symbol for more details about the symbol, as well as recent mentions in Public ChartLists, blog articles, and more.