Table of Contents

Broadening Top or Megaphone Top

What Is a Broadening Top?

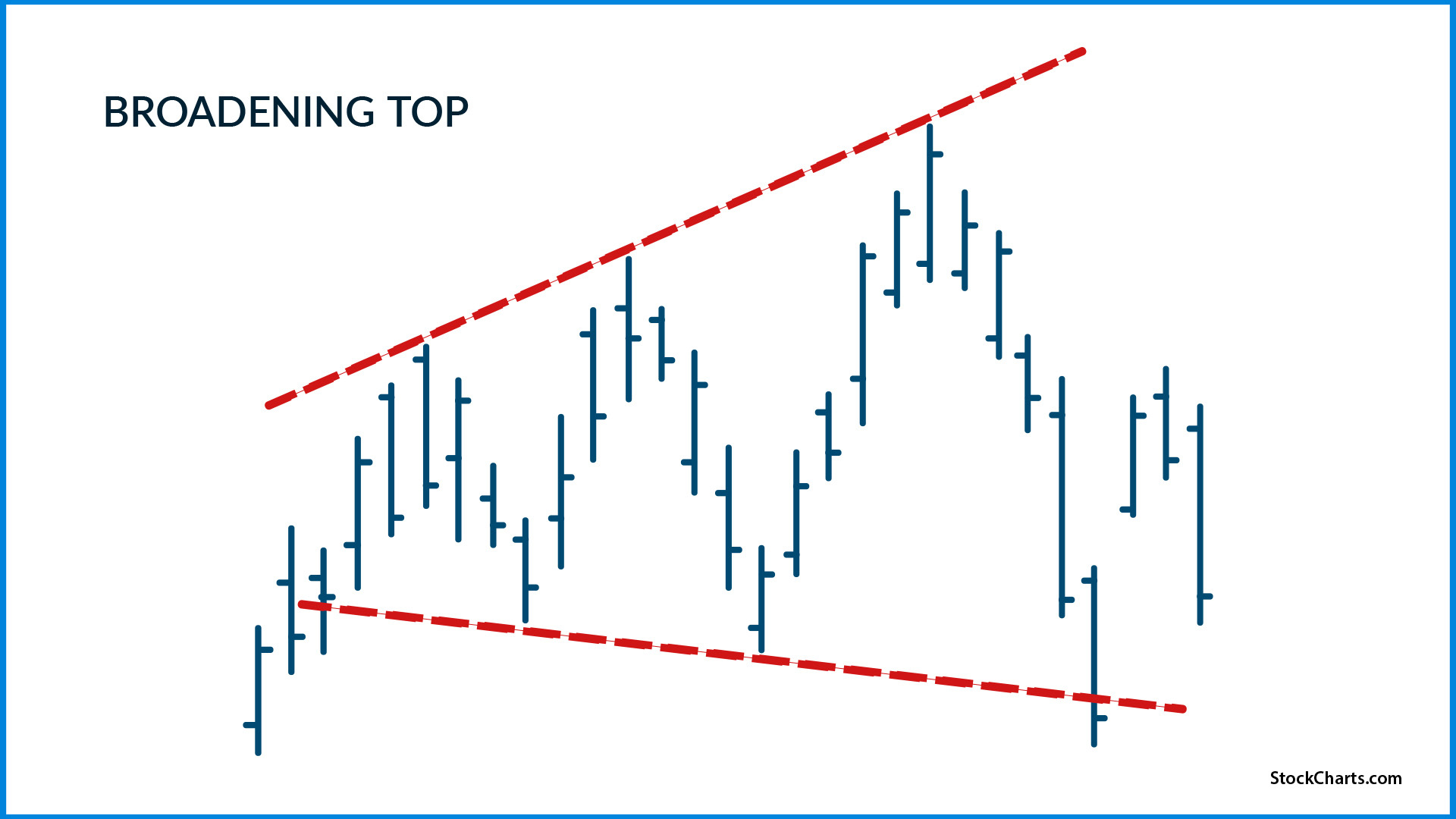

A broadening top is a chart pattern characterized by successive higher peaks and lower valleys. If you were to draw a trendline across the top and bottom of the price action, the pattern would resemble a megaphone or a reverse triangle.

What Does the Broadening Top Indicate?

Perhaps the most reliable indication that any broadening formation tells us—whether it’s a Broadening Top or a Broadening Bottom—is that there’s a volatile disagreement between bullish and bearish investors.

Bullish investors are bidding prices higher, while bearish investors sell (or sell short) the stock, causing it to fall. As a result, you see a series of consecutive higher highs (HHs) and lower lows (LLs).

Are Broadening Tops Bearish or Bullish?

While many long-term investors consider broadening tops to be bearish, as volatility and uncertainty tend to be bearish, the historical performance of this pattern makes it much less discernible:

- Its historical performance as a bearish or bullish pattern is poor, as it tends to pull back into the pattern range over 60% of the time (meaning, if you trade the breakout, it will likely pull back in the opposite direction of your trade).

- For a “topping” formation, its historical statistics tell us that it often tends to rise more than it falls, making it more of a continuation pattern than a reversal pattern.

- Still, the pattern is tradable, but given its volatile characteristics, you might expect it to exhibit wide fluctuations (post-breakout) even if it eventually reaches your profit target.

How Do You Identify Broadening Tops? There are a couple of key characteristics to pay attention to when identifying a Broadening Top:

- Number of Touches. There should be at least five touches in total. Three of these can be peaks or valleys that touch the associated trend line. Two or more touches should be of the other trendline. Bear in mind that a “touch” is different from an “approach” that comes close to the trend line but doesn’t touch. Ideally, the second touch should make contact with the trend line.

- Filled Spaces. Prices should cross the pattern from one side to the other, filling the area with price movement. In short, there shouldn’t be wide “white spaces” in the pattern showing a lack of price activity.

- Breakout Direction. A breakout can occur in any direction and happens when the price pierces a trendline or moves above/below the height of the formation.

How Do You Trade a Broadening Top?

One of the most common approaches to trading a Broadening Top would be to buy an upward breakout or sell a downward breakout.

1 - Compute the height of the pattern. Calculate the difference between the highest peak and the lowest valley. This gives you the “height” of the pattern.

2 - If the breakout is to the upside. Add the pattern's height to the top of the formation to get your potential price target. You can take profits when price reaches 100% of the pattern’s height or close to it.

3 - If the breakout is to the downside. Subtract the height of the pattern from the bottom of the pattern to get your potential price target. You can take profits when price reaches 100% of the pattern’s height.

4 - Place a stop loss at the opposite end of the pattern. In short, place it at the opposite swing high or swing low, depending on whether you’re going long or short.

5 - Beware pullbacks. Once you open your position (long or short), prices tend to pull back into the pattern range over 60% of the time, meaning it will likely go beyond your entry point and in the opposite direction.

Warning: Swing traders may take the opposite direction within the formation (going long or short within the five-touch sequence). While this presents a tradable opportunity, it is a high-risk strategy, so proceed cautiously. What Other Indicators Might Help Me Trade a Broadening Top? The short answer: any indicator that can help you identify overbought and oversold levels. This includes the Relative Strength Index, Stochastic Oscillator, Bollinger Bands, and others.

Also, keep in mind important support and resistance areas, which can be significant historical levels or projected levels such as those that Fibonacci Retracements can determine.

You will also want to pay attention to various volume indicators that can give you insight into buying and selling pressure (such as the Chaikin Money Flow) or, simply, the strength and momentum of a breakout (such as the Rate of Change).

IMPORTANT: Broadening formations (like Broadening Tops and Broadening Bottoms) are often the outcome of disagreements between market participants. These disagreements are often fundamentally based, meaning they stem from broader economic (and sometimes political) risk perceptions. While you can trade them on a technical level, it might help you to be fully aware of the economic (or political) context driving the broader market.

The Bottom Line

A Broadening Top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous.

Given the pattern's tendency for pullbacks, it's best to approach this pattern with prudence and a solid understanding of your risk tolerance. Additionally, while several technical indicators can aid in trading Broadening Tops, understanding the broader economic or political landscapes influencing the pattern can offer invaluable insights. In short, while the Broadening Top presents a trading opportunity, it's a pattern that demands both technical acumen and a finger on the pulse of the larger market narrative.