|

|

Table of Contents

Raff Regression Channel

Introduction

Developed by Gilbert Raff, the Raff Regression Channel is a linear regression with evenly spaced trend lines above and below. The width of the channel is based on the high or low that is the furthest from the linear regression. The trend is up as long as prices rise within this channel. An uptrend reverses when price breaks below the channel extension. The trend is down as long as prices decline within the channel. Similarly, a downtrend reverses when price breaks above the channel extension.

Formula

The Raff Regression Channel (RRC) is based on a linear regression, which is the least-squares line-of-best-fit for a price series. Even though the formula is beyond the scope of this article, linear regressions are easy to understand with a visual example. Chart 1 shows the Nasdaq 100 ETF (QQQQ) with the Raff Regression Channel in red. The middle line is the linear regression extending from the July closing low to the January closing high. Note that the linear regression is based on closing prices. This makes the linear regression the line-of-best-fit for the closing prices from the July low to the January high. Next, the width is set by determining the high or low that is the furthest from the linear regression (early July to mid-January). In this case, the next day's low is the furthest and is used to set the lower channel trend line. The upper trend line is then set the same distance from the linear regression as the lower trend line.

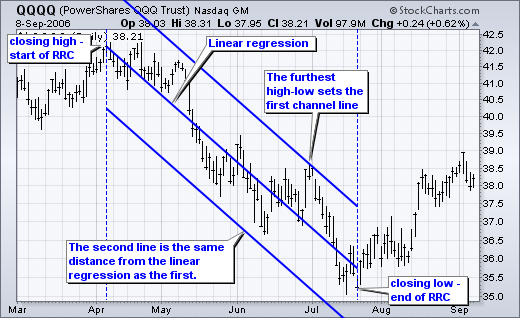

Chart 2 shows an example of QQQQ in a downtrend. The Raff Regression Channel extends from the April (closing) high to the July (closing) low. The late June high defines the width of the channel because it is the furthest high or low from the linear regression. This means the lower trend line is set the same distance from the linear regression as the upper trend line.

Drawing and Signals

The Raff Regression Channel can be drawn to cover the existing trend and subsequently define the trend. Once established, extension lines can be drawn to identify the support, resistance or reversal points. An uptrend extends from the lowest closing low to the highest closing high for a move. A downtrend extends from the highest closing high to the lowest closing low. Keep in mind that closing prices are used when drawing the Raff Regression Channel, but intraday highs and lows are used to set the channel trend lines.

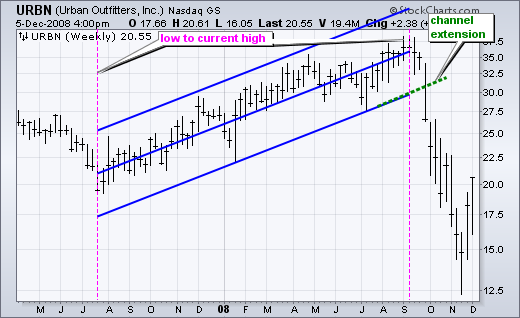

Chart 3 shows Urban Outfitters (URBN) with the Raff Regression Channel drawn from the July 2007 low to the September 2008 high (weekly closes). This covers the uptrend so far. Had URBN moved to a new closing high in October, the Raff Regression Channel would have extended to that high. Instead, URBN broke below the regression channel extension to reverse the uptrend. Notice that the lower trend line was extended to extrapolate the channel.

Chart 4 shows Nvidia (NVDA) with a downtrend extending from the October 2007 high to the November 2008 low. The Raff Regression Channel did not extend further because the stock traded flat and held above its November low into 2009. The red dotted line shows the channel extension of the regression channel top. NVDA broke this extension in February-March to start an uptrend.

Conclusion

As a channel based on a linear regression, the Raff Regression Channel is well suited for trend identification. The width of the channel depends on the furthest high or low from the linear regression. As such, spike highs and lows will result in very wide channels that may not capture the true range. When an uptrend starts with a sharp surge, the low that follows this initial surge is often the furthest high-low from the linear regression. By extension, when a downtrend starts with a sharp decline, the high of this initial decline is often the furthest high-low from the linear regression. Sharp initial moves create wide channels with few, if any, reaction highs or lows touching the upper and lower trend lines. Such was the case with the surge off of the March 2009 lows (see the QQQQ chart further below). Even though this article only focused on trend identification, the Raff Regression Channel can be drawn early in the trend and extended to forecast future support or resistance levels as well as overbought or oversold levels. Channel extensions can act as support or resistance. Moves outside the channel extensions can also denote overbought or oversold conditions.

Using with SharpCharts

You can use our ChartNotes annotation tool to add Raff Regression Channels to your charts. Below, you'll find an example of a chart annotated with two Raff Regression Channel annotations.

To learn more about how to add this annotation to your charts, check out our Support Center article on ChartNotes' Line Study Tools.