|

|

Table of Contents

RSI(2)

What Is the 2-Period RSI Strategy?

Larry Connors developed the 2-period RSI strategy, a fairly simple mean-reversion trading strategy designed to buy or sell securities after a corrective period. Traders should look for buying opportunities when 2-period RSI moves below 10, which is considered deeply oversold. Conversely, traders can look for short-selling opportunities when 2-period RSI moves above 90. This is a rather aggressive short-term strategy designed to participate in an ongoing trend. It is not designed to identify major tops or bottoms. Before looking at the details, note that this article is designed to educate chartists on possible strategies. We are not presenting a standalone trading strategy that can be used right out of the box. Instead, this article is meant to enhance strategy development and refinement.

Strategy

There are four steps to this strategy. First, identify the major trend using a long-term moving average; Connors recommends the 200-day moving average. The long-term trend is up when a security is above its 200-day SMA and down when a security is below its 200-day SMA. Traders should look for buying opportunities when above the 200-day SMA and short-selling opportunities when below the 200-day SMA.

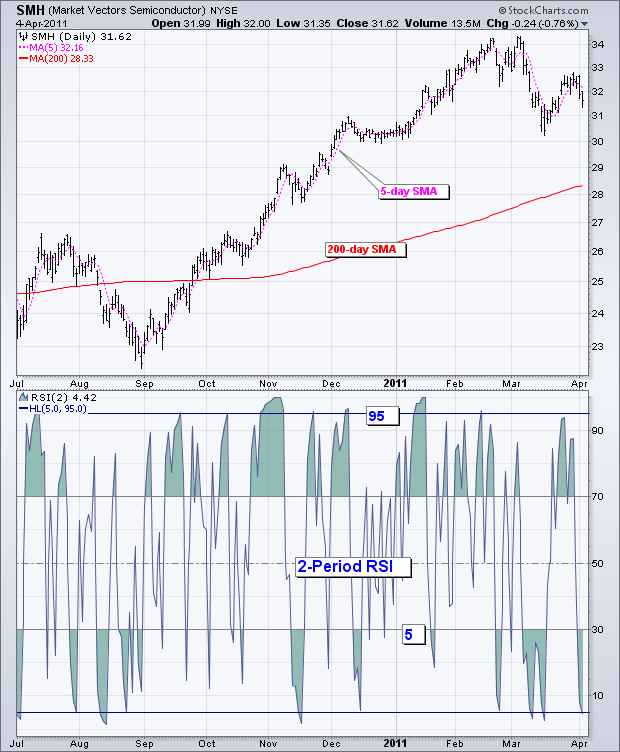

Second, choose an RSI level to identify buying or selling opportunities within the bigger trend. Connors tested RSI levels between 0 and 10 for buying and between 90 and 100 for selling. (Note that levels are based on closing prices.) He found that returns were higher when buying on an RSI dip below 5 than on one below 10. In other words, the lower RSI dipped, the higher the returns on subsequent long positions. For short positions, the returns were higher when selling short on an RSI surge above 95 than on a surge above 90. In other words, the more short-term overbought the security, the greater the subsequent returns on a short position.

The third step involves the actual buy or sell-short order and the timing of its placement. Chartists watching the market can establish a position either just before the close or on the subsequent open. There are pros and cons to both approaches. Connors advocates the before-the-close approach. However, buying just before the close means traders are at the mercy of the next open, which could be with a gap. Obviously, this gap can enhance the new position or immediately detract with an adverse price move. Waiting for the open gives traders more flexibility and can improve the entry level.

The fourth step is to set the exit point. In his example using the S&P 500, Connors advocates exiting long positions on a move above the 5-day SMA and short positions on a move below the 5-day SMA. This is clearly a short-term trading strategy that will produce quick exits. Chartists should also consider setting a trailing stop or employing the Parabolic SAR. Sometimes a strong trend takes hold and trailing stops will ensure that a position remains as long as the trend extends.

Where are the stops? Connors does not advocate using stops. Yes, you read right. In his quantitative testing, which involved hundreds of thousands of trades, Connors found that stops actually “hurt” performance when it comes to stocks and stock indices. While the market does indeed have an upward drift, not using stops can result in outsized losses and large drawdowns. It is a risky proposition, but, then again, trading is a risky game. Chartists need to decide for themselves.

Trading Examples

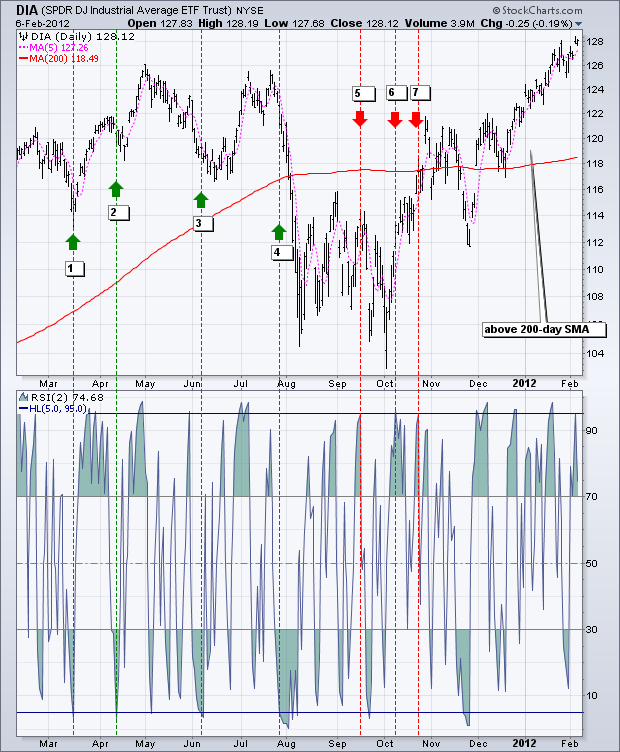

The chart below shows the Dow Industrials SPDR (DIA) with the 200-day SMA (red), 5-period SMA (pink) and 2-period RSI. A bullish signal occurs when DIA is above the 200-day SMA and RSI(2) moves to 5 or lower. A bearish signal occurs when DIA is below the 200-day SMA and RSI(2) moves to 95 or higher. There were seven signals over this 12-month period, four bullish and three bearish. Of the four bullish signals, DIA moved higher three of the four times, which means these signals could have been profitable. Of the three bearish signals, DIA moved lower only once (5). DIA moved above the 200-day SMA after the bearish signals in October. Once above the 200-day SMA, the 2-period RSI did not move to 5 or lower to produce another buy signal. As far as a gain or loss, it would depend on the levels used for the stop-loss and profit taking.

The second example shows Apple (AAPL) trading above its 200-day SMA for most of the timeframe. There were at least ten buy signals during this period. It would have been difficult to prevent losses on the first five because AAPL zigzagged lower from late February to mid-June 2011. The second five signals fared much better as AAPL zigzagged higher from August to January. Looking at this chart, it is clear that many of these signals were early. In other words, Apple moved to new lows after the initial buy signal and then rebounded.

Tweaking the 2-Period RSI Strategy

As with all trading strategies, it is important to study the signals and look for ways to improve the results. The key is to avoid curve fitting, which decreases the odds of success in the future. As noted above, the RSI(2) strategy can be early because the existing moves often continue after the signal. The security can continue higher after RSI(2) surges above 95 or lower after RSI(2) plunges below 5. In an effort to remedy this situation, chartists should look for some sort of clue that prices have reversed after RSI(2) hits its extreme. This could involve candlestick analysis, intraday chart patterns, other momentum oscillators, or even tweaks to RSI(2).

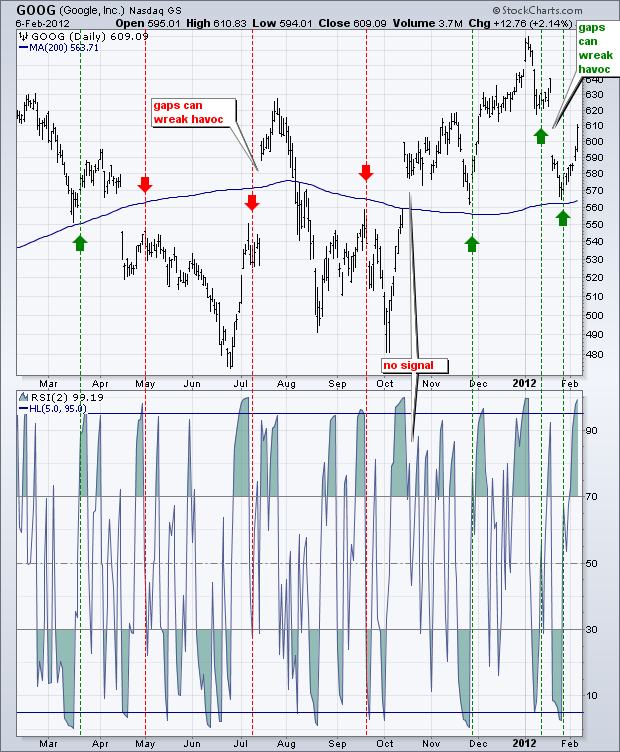

RSI(2) surges above 95 because prices are moving up. Establishing a short position while prices are moving up can be dangerous. Chartists could filter this signal by waiting for RSI(2) to move back below its centerline (50). Similarly, when a security trades above its 200-day SMA and RSI(2) moves below 5, chartists could filter this signal by waiting for RSI(2) to move above 50. This would signal that prices have indeed made some sort of short-term turn. The chart above shows Google with RSI(2) signals filtered with a cross of the centerline (50). There were good signals and bad signals. Notice that the October sell signal did not go into effect because GOOG was above the 200-day SMA by the time RSI moved below 50. Also, note that gaps can wreak havoc on trades. The mid-July, mid-October and mid-January gaps occurred during earnings season.

The Bottom Line

The RSI(2) strategy allows traders to partake in an ongoing trend. Connors states that traders should buy pullbacks, not breakouts. Conversely, traders should sell oversold bounces, not support breaks. This strategy fits with his philosophy. Even though Connors' tests show that stops hurt performance, it would be prudent for traders to develop an exit and stop-loss strategy for any trading system. Traders could exit longs when conditions become overbought or set a trailing stop. Similarly, traders could exit shorts when conditions become oversold. Remember that this article is designed as a starting point for developing a trading system. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Click here for a chart of the S&P 500 with RSI(2).

Suggested Scans

RSI(2) Buy Signal

This scan searches for stocks that have just had an RSI(2) Buy Signal.

[type = stock] and [today's sma(20,volume) > 40000] and [today's sma(60,close) > 20] and [today's close > today's sma(200,close)] and [5 x today's rsi(2)]

RSI(2) Sell Signal

This scan searches for stocks that have just had an RSI(2) Sell Signal.

[type = stock] and [today's sma(20,volume) > 40000] and [today's sma(60,close) > 20] and [today's close < today's sma(200,close)] and [today's rsi(2) x 95]

2-Period RSI Strategy FAQs

What is the 2-period RSI strategy?

The 2-period RSI strategy is a mean-reversion trading strategy developed by Larry Connors, designed to buy or sell securities after a corrective period within an ongoing trend.

What does a 2-period RSI below 10 indicate?

A 2-period RSI below 10 indicates that the security is deeply oversold and presents a potential buying opportunity.

What does a 2-period RSI above 90 indicate?

A 2-period RSI above 90 suggests the security is significantly overbought and may offer a short-selling opportunity.

How do I identify the major trend in the 2-period RSI strategy?

The major trend is identified using a 200-day simple moving average (SMA). If the security is above its 200-day SMA, the trend is up, and you should look for buying opportunities. If it's below, the trend is down, and you should look for short-selling opportunities.

Can the 2-period RSI strategy be used to find market tops or bottoms?

No, the 2-period RSI strategy is not designed to identify major tops or bottoms; it's a short-term strategy aimed at trends.

What is the suggested timing for placing orders using this strategy?

Orders can be placed just before the market close or on the subsequent open. Connors recommends the before-the-close approach.

How can false signals be filtered in this strategy?

False signals can be filtered by waiting for RSI(2) to move back below its centerline (50) for short positions, or above 50 for long positions after reaching extreme levels.

What is Connors' philosophy regarding pullbacks and breakouts?

According to Connors, you should buy on pullbacks, not breakouts, and sell on oversold bounces, not support breaks.