|

|

Table of Contents

Bullish Percent Index

What Is the Bullish Percent Index?

The Bullish Percent Index (BPI) is a breadth indicator based on the number of stocks on Point & Figure Buy Signals within an index. The BPI helps you understand the internal health of an index by looking at the number of components that are on a bullish or bearish track.

Abe Cohen developed the indicator in the mid-1950s. The Bullish Percent Index was originally applied to NYSE stocks. Cohen was the first editor of ChartCraft, which later became Investors Intelligence. Earl Blumenthal further refined BPI signals in the mid-70s and Mike Burke in the early 80's. Because a stock is either on a P&F buy or sell signal, there is no ambiguity when it comes to P&F charts. This makes BPI a straightforward indicator with clearly defined signals. We'll look at six different Bullish Percent Index signals derived from Point & Figure charts: bull/bear confirmed, bull/bear alerts, and bull/bear correction.

How Is the Bullish Percent Index Calculated?

The calculation is straightforward.

Number of stocks on P&F Buy signals/total number of stocks

Bullish Percent calculations use traditional box sizing and 3-box reversal P&F charts.

P&F Patterns

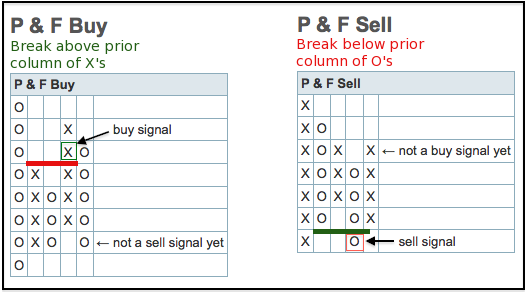

There are over a dozen P&F signals, though only two are relevant to BPI calculations. X's represent advancing columns and O's represent declining columns. P&F columns alternate as prices reverse and change direction. A basic P&F Buy Signal occurs when a column of X's exceeds the prior column of X's. A basic P&F Sell Signal occurs when a column of O's exceeds the prior column of O's. It's that simple. P&F charting techniques are discussed in further detail in our ChartSchool article.

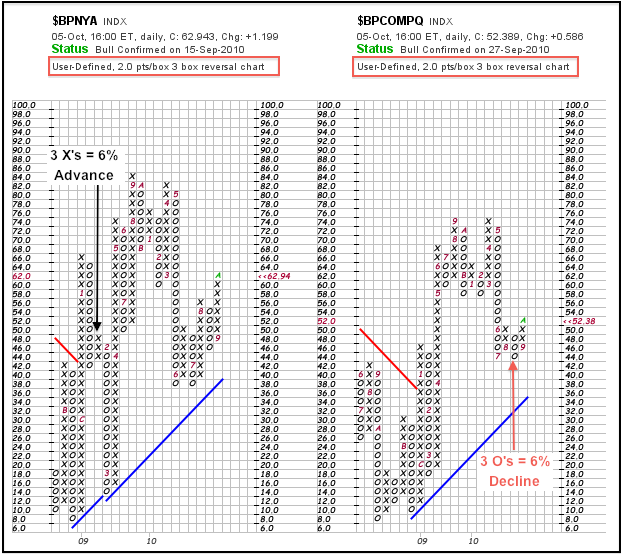

StockCharts.com uses traditional 3-box reversal P&F charts for the Bullish Percent Indices. Each box represents 2%. This means it takes at least a 6% move in BPI for a reversal. Three boxes at 2% equals 6% (3 x 2% = 6%). A 6% move would be from 42% to 48% or from 64% to 58%. 6% does not refer to the actual percentage change. A column of O's (decline) can only be reversed with a 6% advance, which would form a new column with three X's. A column of X's (advance) can only be reversed with a 6% decline, which would form a new column with three O's.

Interpreting the Bullish Percent Index

The Bullish Percent Index (BPI) fluctuates between 0% and 100%. StockCharts.com calculates BPI for a number of sectors, industry groups, and indices. The indicator's range and volatility largely depend on the number of stocks in the underlying index. An index with 30 or fewer stocks, such as the Gold Miners Index, Dow Industrials, or Dow Transports, may occasionally reach 0% or 100%. Indices with over 2000 stocks, such as the Nasdaq and NYSE, are unlikely to reach 0% or 100%. Indexes with fewer stocks are also more volatile because moving the Bullish Percent Index takes fewer stocks.

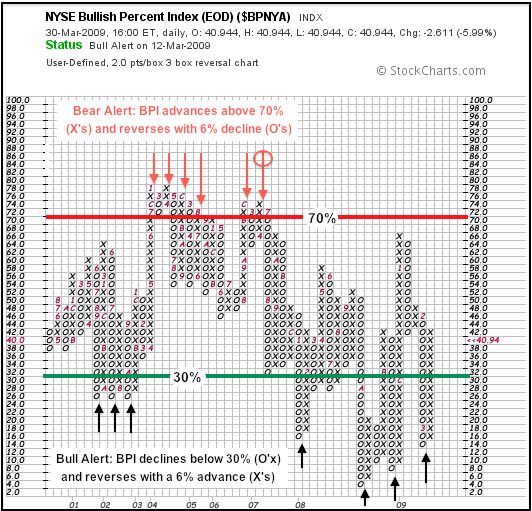

In its most basic form, the Bullish Percent Index favors bulls when it's above 50% and bears when below 50%. The bulls have the edge when over 50% of stocks are on a P&F Buy Signal. BPI is considered overbought when above 70% and oversold when below 30%. In addition to these basic interpretations, three signal pairings have evolved. Below is a description covering the basic elements of these signals. Cohen, Blumenthal, and Burke also used specific BPI levels to qualify signals, such as 30%, 49%, 50%, 52%, 68% and 70%. The signals in this article focus on the basic elements.

- Bull Alert: BPI is below 30% and then forms a new column of X's (rises)

- Bear Alert: BPI is above 70% and then forms a new column of O's that decline below 70%.

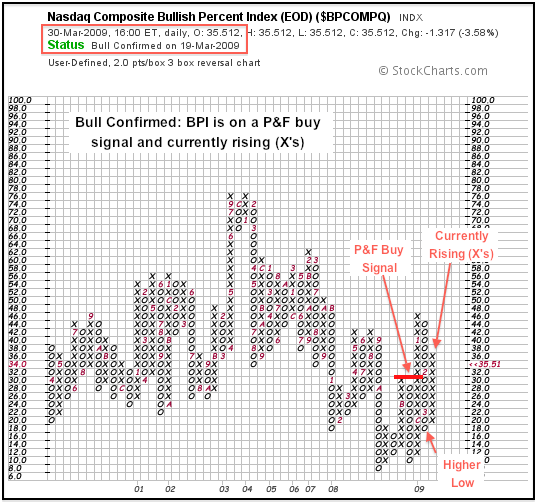

- Bull Confirmed: BPI is on a P&F buy signal and in a column of X's (rising).

- Bear Confirmed: BPI is on a P&F sell signal and in a column of O's (falling).

- Bull Correction: BPI is on a P&F buy signal, but currently falling (column of O's).

- Bear Correction: BPI is on a P&F sell signal, but currently rising (column of X's).

Bull/Bear Alert

A bull alert signals that the market may be forming a bottom. With the Bullish Percent Index below 30% and a column of O's underway, there is widespread weakness. Also, notice that 30% is used as an oversold threshold. Because an index or indicator can become oversold and remain oversold, BPI must be oversold AND start to rise to trigger a bull alert. This means BPI must bounce at least 6% (three box reversal) to start a column of X's (rise). The black arrows on the chart below show the NYSE Bullish Percent Index ($BPNYA) dipping below 30% and then reversing with a column of X's. This signal alerts chartists that breadth is improving from oversold conditions. Such signals can foreshadow a bottom in stocks, such as the Bull Alerts in October 2002, March 2003 and March 2009. Not all Bull Alerts result in Bottoms, but these signals should put chartists on a heightened alert.

The Bear Alert is the opposite of the Bull Alert. The Bullish Percent Index advances above 70% to become overbought. This means that over 70% of stocks in a particular index are on P&F Buy Signals. A subsequent 6% decline (3-box) forms a new column of O's to trigger the Bear Alert (red arrows). This is not a Sell Signal, but rather an alert to be prepared for a decline or market weakness. Some signals, such as in July 2007, can foreshadow bigger declines (red circle).

Bull/Bear Confirmed

The Bull Confirmed signal shows the most strength because BPI is on a P&F Buy Signal and rising. BPI is rising when the column on the far right is made up of X's. A Buy Signal occurs when a column of X's exceeds the high set by the prior column of X's. This is essentially a higher high. A Buy Signal remains in force until a column of O's exceeds the low of the prior column of O's, which is a basic P&F Sell Signal.

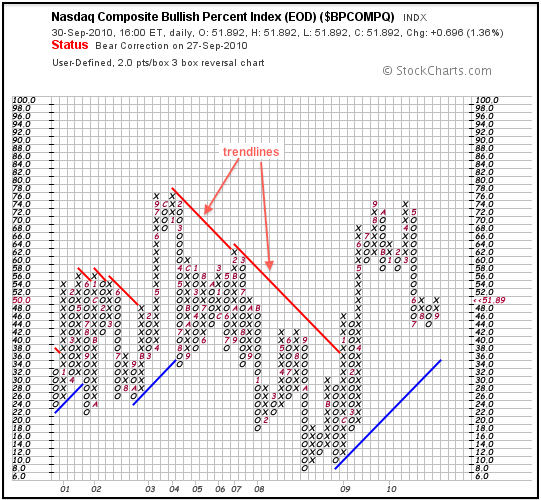

On the chart above, the Nasdaq Bullish Percent Index ($BPCOMPQ) triggered a P&F Buy Signal with the breakout in December 2009. Notice that the breakout point is between the “C” marking December and the “1” marking January. Despite a deep pullback in March, this signal remained in force because the Nasdaq Bullish Percent Index held above the prior low (column of O's). With a P&F Buy Signal in place, the subsequent rebound triggered the Bull Confirmed signal. The status for the Bullish Percent Index charts can be seen at the top left, just under the symbol.

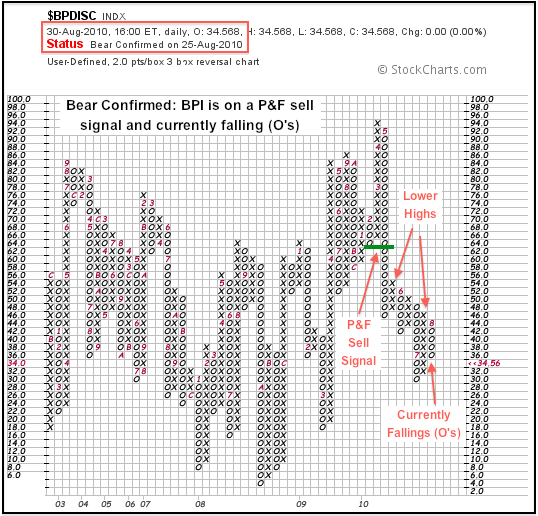

As expected, the Bear Confirmed signal shows the most weakness because BPI is on a P&F Sell Signal and falling. A Sell Signal occurs when the column of O's moves below the prior low. This signal remains in force until canceled with a Buy Signal. Even though the BPI can rebound with a column of X's, it remains on a P&F Sell Signal until that column of X's exceeds the high of the prior column of X's. As long as the P&F Sell Signal remains in force, the Bear Confirmed signal appears with each subsequent decline (column of O's).

The chart above shows the Consumer Discretionary Bullish Percent Index ($BPDISC) with a Bear Confirmed signal in August 2010. It all started when BPI broke below its prior low to trigger a P&F Sell Signal. Despite subsequent rally attempts, each column of X's formed a lower high and failed to reverse the Sell Signal. Each downturn (column of O's) triggered the Bear Confirmed signal. This signal will not be reversed until BPI breaks above its prior high (column of X's).

Bull/Bear Correction

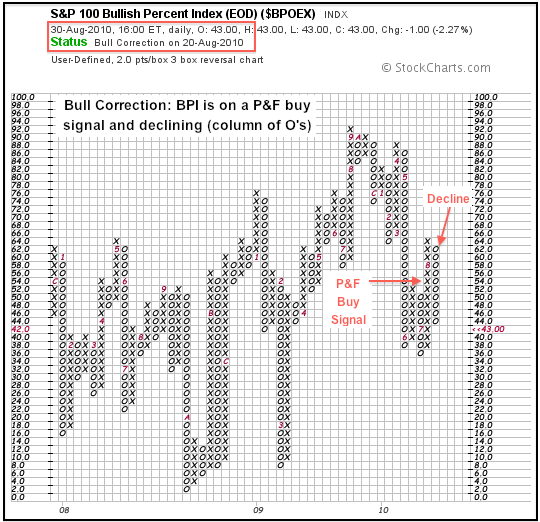

The Bull Correction signal occurs when the Bullish Percent Index is on a P&F Buy Signal, but declining with a current column of O's. Keep in mind that the P&F Buy Signal remains in force until reversed with a P&F Sell Signal. The chart below shows the S&P 100 Bullish Percent Index ($BPOEX) breaking resistance to trigger a P&F Buy Signal in July 2010. After peaking around 66%, BPI declined below 50% with a column of O's. This represents a correction after the Buy Signal, hence a Bull Correction signal. It would take a break below the prior low (column of O's) to reverse the Buy Signal.

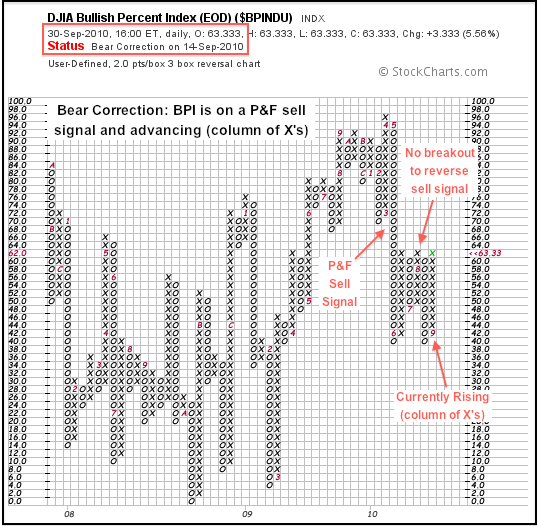

A Bear Correction signal occurs when the Bullish Percent Index is on a P&F Sell Signal, but advancing with a current column of X's. Any advance remains a correction until there is a breakout to reverse the Sell Signal. The chart below shows the Dow Industrials Bullish Percent Index ($BPINDU) breaking support with a long decline in May to trigger a P&F Sell Signal. Despite three rally attempts, BPI was not able to break above the prior high to reverse this Sell Signal. Notice that BPI made it up to the prior highs, but did not break out. These advances are corrections within a bigger downtrend as long as the P&F Sell Signal remains in force.

The Bottom Line

The Bullish Percent Index offers something for all sorts of traders. Bottom pickers can look for bullish reversals below 30%. Top pickers can look for bearish reversals above 70%. These are the more risky entries because tops and bottoms can extend over time. There may also be a test of the prior lows or prior highs. Trend followers can look for bullish reversals occurring above the 50% level. A bullish bias is already present when over 50% of stocks are on P&F Buy Signals. A new column of X's above 50% signals renewed strength when the bias is bullish. A bearish bias exists when below the 50% threshold. A new column of O's signals renewed weakness when the bias is already bearish. Traders can use the Bullish Percent Indices to define a trading bias before looking for individual stocks or ETFs to trade. Buy Signals are preferred when the Bullish Percent Index favors the bulls. Sell Signals are preferred when the Bullish Percent Index favors the bears. Using the Bullish Percent Index together with other indicators is important.

Symbols Available

StockCharts.com calculates and publishes the Bullish Percent Indices for 7 major indices, 11 sectors, and 2 industry groups. These indicators are calculated at the end of the trading day, which is why “(EOD)” appears in the name.

Predefined CandleGlance charts can be viewed for the Major BPI symbols or the Sector BPI Symbols, or users can create their own. The default CandleGlance page shows these as line charts. Users can change to P&F charts by going to the “duration” settings at the bottom and changing to “point & figure”.

Alternatively, chartists can make individual charts for any of our BPI symbols. StockCharts.com users can access an up-to-date list of symbols for all our Bullish Percent Indices. From this list, click the “Mentions” icon to the right of a specific symbol for more details about the symbol and recent mentions in Public ChartLists, blog articles, and more.

SharpCharts

The Bullish Percent Indices can be viewed as close-only line charts or as P&F charts. As normal line chart, users can add indicators or change the chart “type” to anything that fits a “close only” plot, such as Renko or Kagi charts. When viewing in P&F mode, the “status” is shown at the top. This makes it easy to see if BPI is Bull Confirmed, Bear Correction, Bull Alert or one of the other signals. P&F charts are easy to create at StockCharts.com. Choose “P&F Chart” from the “Create a Chart” option at the top of any page. Click “Go” to see the chart. A SharpChart can be converted into a P&F chart by simply clicking the “Point & Figure Chart” link underneath a Sharpchart. Click here to see a live chart for the Nasdaq Bullish Percent Index ($BPCOMPQ).

Further Study

In his book Point & Figure Charting, Thomas Dorsey describes, step-by-step, how to create, maintain and interpret your own Point and Figure charts with regard to markets, sectors and individual securities. He then explains how to use these findings to track and forecast market prices and develop an overall investment strategy.

Jeremy du Plessis's The Definitive Guide to Point and Figure covers the details of P&F chart patterns and their interpretation. Readers are encouraged to understand Point and Figure charts based on supply-demand principles, rather than just remembering the names. Readers also learn to project targets and calculate risk-reward ratios by applying P&F principles to real-world trading situations.