|

|

Table of Contents

The Hindenburg Omen

What is the Hindenburg Omen?

The Hindenburg Omen is a technical market pattern that indicates a heightened risk of a stock market downturn. It’s a controversial indicator because of its potential to stir up fear and its history of generating false positives, which can often be as high as 80%.

Despite this statistic, a few market crashes preceded by a Hindenburg Omen were substantial, making it an “early warning system” worthy of close attention.

The Origins of the Hindenburg Omen

Developed and introduced by James Mekka in 2010, the Hindenburg Omen is named after the infamous Hindenburg zeppelin disaster of 1937. The indicator aims to identify the conditions signaling a potential market crash.

What Components Make Up the Hindenburg Omen?

The inputs that make up the Omen can be reduced to three conditions:

- The broader market is in an uptrend,

- A significant number of NYSE stocks hitting both 52-week highs and lows simultaneously, and

- A negative reading in the McClellan Oscillator (MCO) signals a negative market sentiment and momentum shift.

Let’s take a closer look at these indicators.

1 - Market Uptrend

The first condition in a Hindenburg Omen is that the broader stock market is in an uptrend. There are different ways to determine this: For instance, the NYSE index is higher than its value from 50 trading days (approximately ten weeks) prior, or the slope of the 10-week simple moving average, which is the 50-day moving average.

2 - Expansion in 52-Week Highs and Lows

The second condition is that NYSE stocks simultaneously hit new 52-week highs and 52-week lows. This indicates market indecision, as both buyers and sellers are causing stocks to expand in both positive directions at once. More specifically, this condition is met when new highs and new lows comprise at least 2.8% of NYSE listings.

3 - McClellan Oscillator Goes Negative

The last component involves the McClellan Oscillator (MCO), a measure of market breadth. A break below zero in this oscillator indicates negative momentum in net advancers. This suggests potential deterioration in market breadth, which, in turn, indicates potential downside.

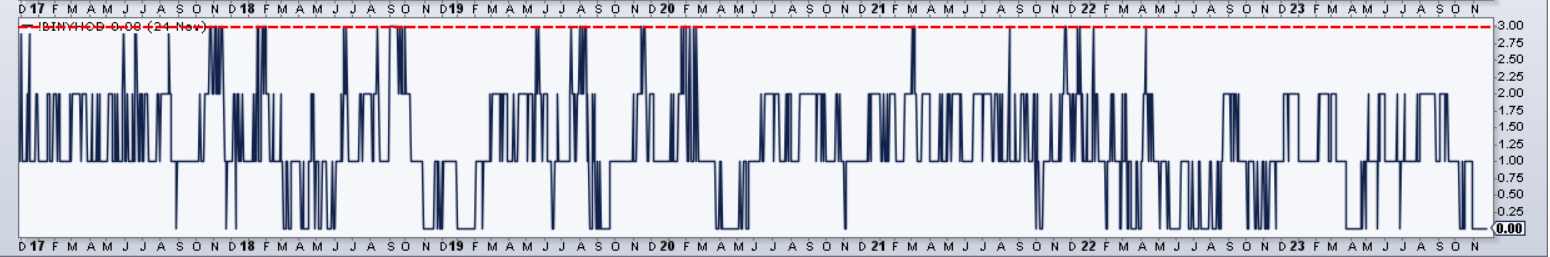

You can view all three above conditions with the StockCharts Hindenburg Omen indicator using the symbol !BINYHOD (see below).

Note the red line at the value level of 3, which is the indicator's highest level. Each time the line reaches 3, a Hindenburg Omen signal is given. What’s important, however, are not the individual signals but the cluster of signals occurring within a 30-day time period.

How Do You Read the Hindenburg Omen Signals?

Here’s where we get to an important set of factors: clusters and timing are critical. Look for a cluster of signals. One Omen signal may not be significant, but a cluster of signals may prove significant.

Once the signal is triggered, it can remain valid for 30 trading days. Subsequent signals within this period are disregarded. It’s important to remember that Hindenburg Omen signals are active only when the MCO is negative, and inactive when the MCO is positive during these 30 days.

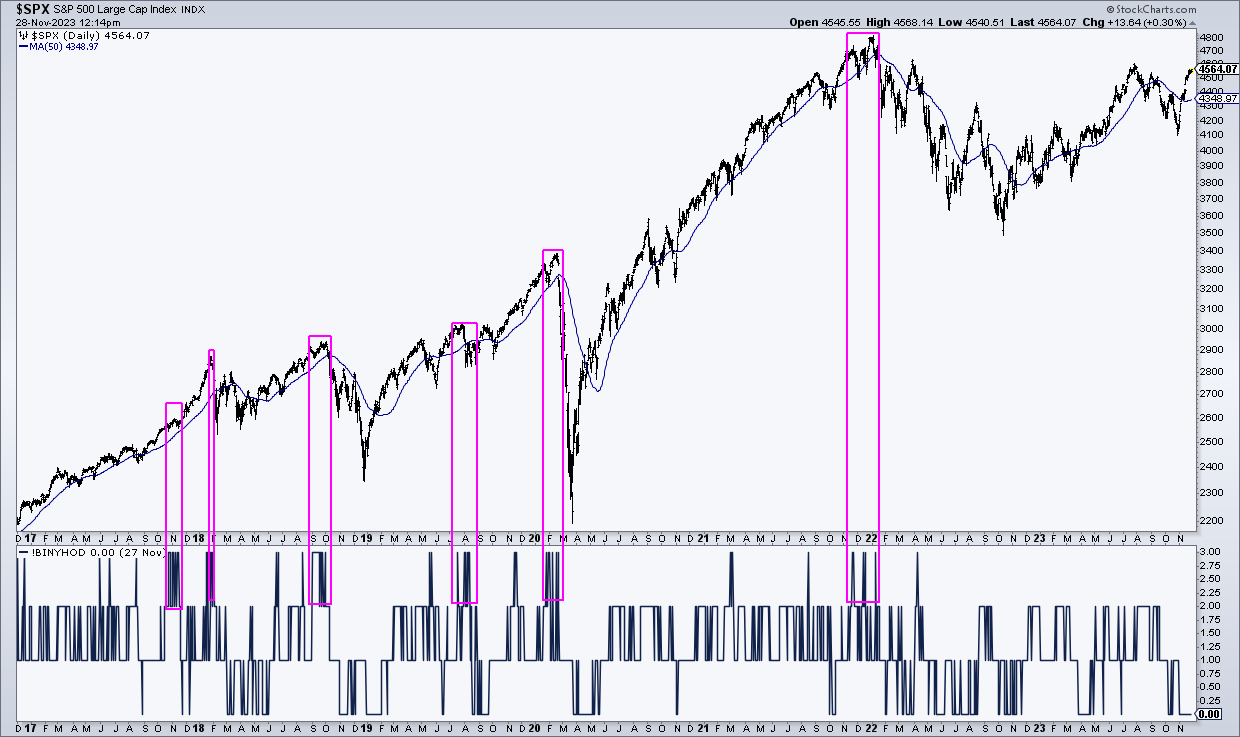

Let’s take a closer look at this. Below is the seven-year daily chart of the S&P 500 index ($SPX) with a 50-day SMA overlay. The panel below displays the Hindenburg Omen.

![]() StockCharts Tip:

StockCharts Tip:

- To add !BINYHOD to SharpCharts, from the Indicators section, select Price from the Indicators dropdown menu. Add !BINYHOD to the Parameters box and position it below the price chart.

- For StockChartsACP, select Price from the Standard Indicators list, and add !BINYHOD in the Symbol box.

The 50-year moving average overlay illustrates the slope of the trend (as mentioned in the criteria above). The magenta boxes highlight areas in which the Hindenburg Omen signals are clustered.

Going from left to right, the November 2017 signal didn’t result in any decline, but the February 2018 signal did. A small pullback followed the July 2019 signal, but the big crash came in February 2020 when the signal clusters were particularly strong. While the November and December (2021) and January (2022) signals were virtually 30 days apart, making them not so much clusters but consecutive occurrences, what did follow was a volatile 9-month period culminating in a sizable net decline.

As you can see, although significant declines don’t follow most individual signals, most clustered signals preceded almost all sizable to significant market downturns.

The Bottom Line

Based on historical studies, the Hindenburg Omen, with its 20% accuracy rate, may be prone to many false positives, but it tends not to miss the big downward moves when they occur. The chart above is one illustration of this thesis. This means you’ll have to use other tools to distinguish the false positives from the real signals, knowing that the Omen, at best, can serve as a powerful red flag and early warning sign of significant market downturns.

Hindenburg Omen FAQs

What are the three components that make up the Hindenburg Omen?

The three components are the overall market being in an uptrend, an expansion in both new 52-week highs and lows on the NYSE, and a negative McClellan Oscillator.

What is the time factor involved in the Hindenburg Omen?

A valid signal requires multiple instances within a 30-day window to confirm a bearish indication.

How can you track the Hindenburg Omen?

You can use the StockCharts indicator (!BINYHOD) that aggregates the three components of the Hindenburg Omen.

What does a value of 3 in the Hindenburg Omen indicator signify?

A value of 3 indicates that all three components of the Omen are currently triggered.

How should you react to a Hindenburg Omen signal?

You should proceed cautiously, paying close attention to how price responds to key support levels.

Should you take significant action based solely on the Hindenburg Omen?

Given its tendency for false positives, you don’t want to use Hindenburg Omens as a trigger for trades. Instead, use it as a cue for increased vigilance to inform your current trading approach and strategy.