|

|

Table of Contents

Know Sure Thing (KST)

Introduction

Developed by Martin Pring, Know Sure Thing (KST) is a momentum oscillator based on the smoothed rate-of-change for four different timeframes. Pring first described the indicator in the 1992 “Summed Rate of Change (KST)” in Stocks & Commodities magazine. In short, KST measures price momentum for four different price cycles, combining them into a single momentum oscillator. Like any other unbound momentum oscillator, chartists can use KST to look for divergences, signal line crossovers, and centerline crossovers. Pring frequently applied trend lines to KST. Although trend line signals do not occur often, Pring notes that such breaks reinforce signal line crossovers.

SharpCharts Calculation

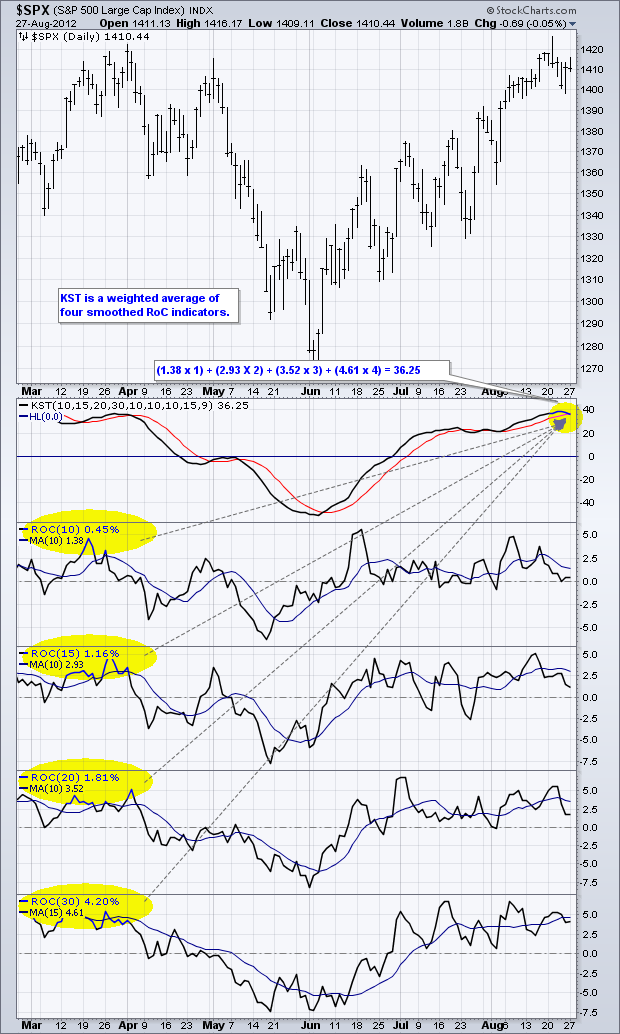

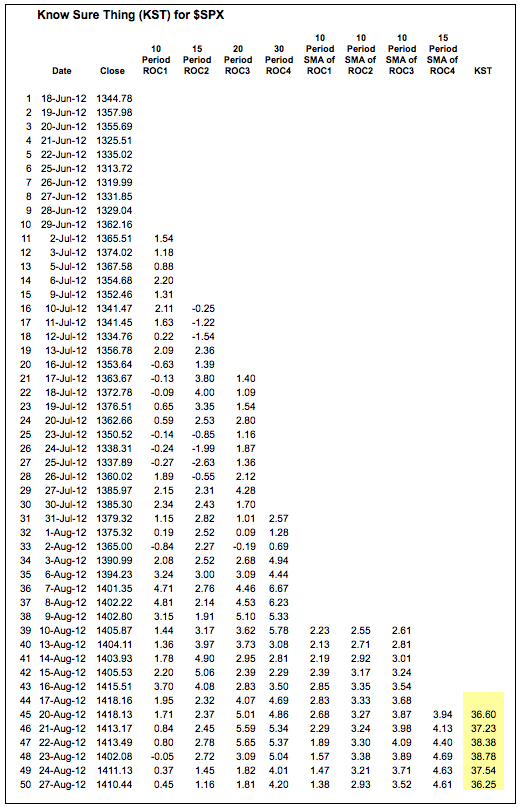

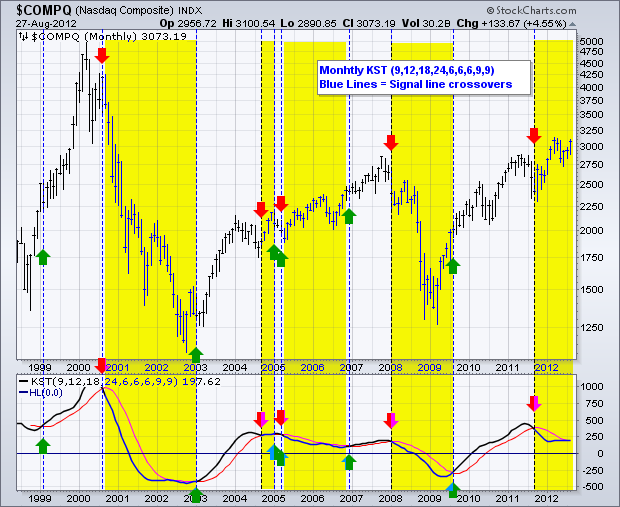

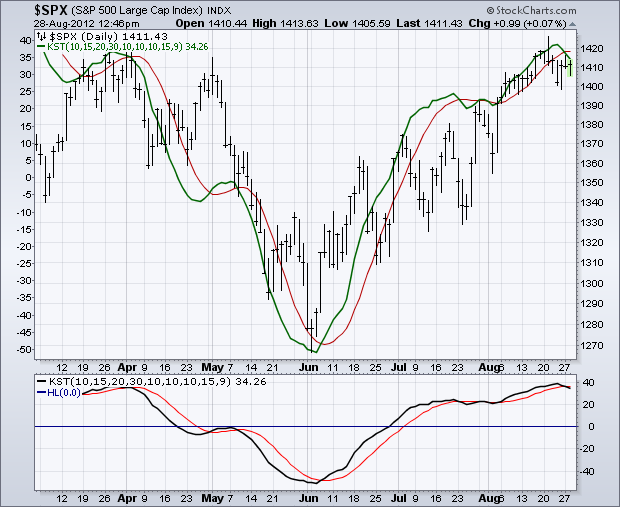

Even though the formula for KST looks complicated, it is simply a weighted average of four different rate-of-change values that have been smoothed. For example, calculate the 10-period rate-of-change and then smooth it with a 10-period simple moving average. The chart below shows the four different rate-of-change indicators with the appropriate moving averages for smoothing.

The formula box below shows the four different combinations with their default settings. These combinations are then weighted and summed. The shortest timeframe carries the least weight (1) and the longest timeframe carries the most weight (4). A 9-period simple moving average is added as a signal line.

RCMA1 = 10-Period SMA of 10-Period Rate-of-Change RCMA2 = 10-Period SMA of 15-Period Rate-of-Change RCMA3 = 10-Period SMA of 20-Period Rate-of-Change RCMA4 = 15-Period SMA of 30-Period Rate-of-Change KST = (RCMA1 x 1) + (RCMA2 x 2) + (RCMA3 x 3) + (RCMA4 x 4) Signal Line = 9-period SMA of KST

The default parameters are as follows: KST(10,15,20,30,10,10,10,15,9). The first four numbers represent the rate-of-change settings, the second four represent the moving averages for these rate-of-change indicators and the last number is the signal line moving average.

Click here to download this spreadsheet example and try it at home.

Interpretation

KST fluctuates above/below the zero line. At its most basic, momentum favors the bulls when KST is positive and favors the bears when KST is negative. A positive reading means the weighted and smoothed rate-of-change values are mostly positive and prices are moving higher. A negative reading indicates that prices are moving lower.

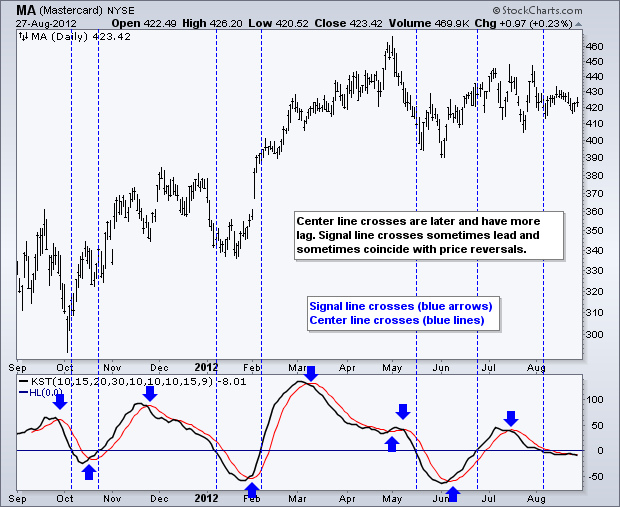

After basic centerline crossovers, chartists can look for signal line crossovers and gauge general direction. KST is generally rising when above its signal line and falling when below its signal line. A rising and negative KST line indicates that downside momentum is waning. Conversely, a falling and positive KST line indicates that upside momentum is waning.

Even though there are many different signals possible with KST, the basic centerline and signal line crossovers are usually the most robust. Unlike RSI and the Stochastic Oscillator, KST does not have upper or lower limits. This makes it relatively ill-suited for overbought and oversold signals.

Divergences

Bullish and bearish divergences are also possible for signals, but chartists need to be selective when using these. Most divergences in the basic rate-of-change indicator do not result in price reversals. Similarly, divergences in MACD and RSI are also prone to failure. It is probably best to use divergences when there is a large and blatant divergence. The example below shows BroadCom (BRCM) with a large bearish divergence and a large bullish divergence. These divergences were finalized with subsequent signal line crossovers (red and green arrows).

Strong Trends

Chartists should be careful with bearish signal line crossovers in strong uptrends and bullish signal line crossovers in strong downtrends. KST can move into positive territory and remain in positive territory for an extended period during a strong uptrend. The indicator will reach a relatively high level and then turn down, but never move into negative territory. This simply signals that upside momentum is slowing; it is still stronger than downside momentum, but not as strong as in previous periods. The example below shows Sherwin Williams (SHW) with a strong uptrend from November 2011 to August 2012. Even though KST fluctuated up and down, it never broke below zero and remained in positive territory the entire time. The bearish signal line crossovers simply indicated a slowing in upside momentum, not a trend change.

Timeframes

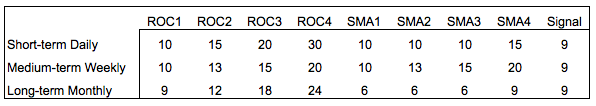

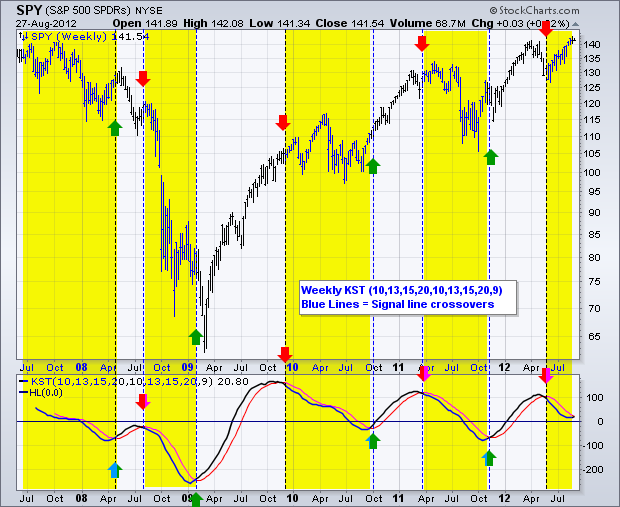

- Short-term Daily = KST(10,15,20,30,10,10,10,15,9)

- Medium-term Weekly = KST(10,13,15,20,10,13,15,20,9)

- Long-term Monthly = KST(9,12,18,24,6,6,6,9,9)

As noted in Pring's articles, KST can be used on a short-term, medium-term or long-term timeframe. Instead of just shifting between daily, weekly and monthly charts, Pring suggested changing the settings to suit each timeframe. KST is even smoother when using the weekly and monthly settings. This means chartists should use signal line crossovers to detect directional changes in price. The lag for centerline crossovers is often too great. The table below shows the rate-of-change settings and moving average settings for the short-term, medium-term and long-term studies.

Further Tweaks

Martin Pring would be the first to admit that KST is not a perfect indicator. There is no such thing. KST does, however, have its uses - Pring encourages chartists to try different settings because one size does not fit all. Utility and consumer staples are less volatile and may require more sensitive settings. Technology stocks are more volatile and may require less sensitive settings.

Chartists can also mix and match the rate-of-change settings and the moving average settings. The chart below shows the default KST in the first indicator window and a KST weighted in favor of the short-term rate-of-change in the second window. Instead of KST(10,15,20,30,10,10,10,15,9) the second window shows KST(30,20,15,10,10,10,10,10,9). The first rate-of-change setting carries the least weight and the fourth one carries the most weight. Note that the first four numbers represent the rate-of-change settings. The second four numbers represent the moving averages to smooth these four rate-of-change indicators. The final number is the signal line.

Conclusion

Know Sure Thing (KST) is a momentum oscillator based on the smoothed rate-of-change over four different time periods. In this regard, it is designed to capture four different price cycles. KST can be used like other unbound momentum oscillators, such as MACD, the Percent Price Oscillator and TRIX. In fact, KST closely resembles TRIX. Because it is unbound, KST is not well suited for identifying overbought and oversold conditions. KST's creator, Martin Pring, favors signal line crossovers and trend line breaks for signals. As with all indicators, KST should be used in combination with other analysis techniques.

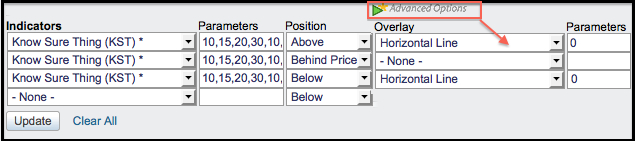

Using with SharpCharts

KST is available as an indicator for SharpCharts. Once selected, users can place the indicator above, below or behind the underlying price plot. Placing KST directly behind the price plot accentuates the movements relative to the price action of the underlying security. Users can apply “advanced options” to add a horizontal line. Adjusting the numbers in the parameters box will change the settings.

Suggested Scans

Bullish KST Signal Line Cross

This scan reveals stocks where KST is in positive territory. A bullish signal is triggered when KST crosses above its signal line.

[type = stock] AND [country = US] AND [Daily SMA(20,Daily Volume) > 40000] AND [Daily SMA(60,Daily Close) > 20] AND [KST > 0] AND [KST x KST Signal]

Bearish KST Signal Line Cross

This scan reveals stocks where KST is in negative territory. A bearish signal is triggered when KST crosses below its signal line.

[type = stock] AND [country = US] AND [Daily SMA(20,Daily Volume) > 40000] AND [Daily SMA(60,Daily Close) > 20] AND [KST < 0] AND [KST Signal x KST]

For more details on the syntax to use for KST scans, please see our Scan Syntax Reference in the Support Center.

Further Study

Technical Analysis of the Financial Markets has a chapter devoted to momentum oscillators and their various uses. Murphy covers the pros and cons as well as some examples specific to Rate-of-Change. Martin Pring's Technical Analysis Explained explores the basics of momentum indicators by covering divergences, crossovers and other signals. There are two more chapters covering specific momentum indicators, each containing plenty of examples.